Form 1040 State And Local Income Tax Refund Worksheet

This is the maximum amount of the total refund. Medicaid waiver payments to care provider.

Us Tax Abroad Expatriate Form 1040

Kelly and Chanelle Chambers ages 47 and 45 are.

/1040-NR-EZ-NonresidentAlienswithNoDependents-1-992eb3e7ab6d49b782ad46ab42ae00e5.png)

Form 1040 state and local income tax refund worksheet. You may need to scroll down in the section to locate the item. Choose Setup 1040 Individual click the Other Return Options button click the Other tab and mark the Print Tax Refund Worksheet if applicable box. Individual Income Tax Return and Publication 525 Taxable and Nontaxable Income.

Is the amount on line 5 less than the amount on line 2. For information about other TCJA provisions visit IRSgovtaxreform. Federal Individual Income Tax Return for their 2014 tax year.

Other Gains or Losses Line 7. 525 to figure if any of your refund is taxable. The Tax Refund Worksheet calculates based on the data you enter in this section and if you do the following for all of your clients.

Form 1040 Schedule A Sch B Sch C Sch SE Form 4684 Tax Computation Worksheet. Add lines 3 and 4 5. State and local income tax refunds prior year Income tax refunds credits or offsets 2 2.

State and Local Income Tax Refund WorksheetSchedule 1 Line 10 Be sure you have read the Exception in the instructions for this line to see if you can use this worksheet instead of Pub. Go to the 99G screen and enter information in the Additional Box 2 Information fields. Use only the following forms.

Refunds attributable to post-20XX ESextension payments. Total state and local taxes deducted on 2016 return. Use a copy of the taxpayers previous year return to enter all amounts in the spaces provided.

To review the calculations andor print the State Income Tax Refund worksheet. The taxpayers prior year state and local tax refund is greater than the prior year state and local income tax deduction minus the amount that the taxpayer could have deducted as the prior year state and local sales tax. Worksheet 5 - State and Local Income Tax and General State Sales Tax Computation Keep for your records 1 Enter the total amount from Schedule A line 5 1 1 Enter the total state and local taxes actually paid in 2015 1 1 Enter the amount from line 1 worksheet 1 above 1 2 Enter the amount from line 1 worksheet 2 above 2 3 Subtract line 2 from line 1.

The taxable portion will be included on the return as taxable income. Use this worksheet to determine the portion of the taxpayers prior year state refund that is considered taxable in the current year. Add lines 3 and 4 5.

Enter the income tax refund from Forms 1099-G or similar statement. Is the amount on line 5 less than the amount on line 2. Include state tax withheld and state.

Understanding the State Refund Worksheet. Taxable part of your refund. Yes Subtract line 5 from line 2 No STOP None of your refund is taxable.

The IRS is basically preventing double-dipping. Unemployment Compensation Exclusion WorksheetSchedule 1 Line 8. Calculate and view the return.

The Form 1040 2018 State and Local Income Tax Refund Worksheet form is 1 page long and contains. Click Print and then click the PDF link. State local income tax refunds.

The following facts are available to help prepare Kelly and Chanelle Chambers U. The taxpayer made estimated state and local income tax payment for the prior year in. Get your taxes done.

Subtract line 7 from line 1 Enter the total state taxes actually paid in 2016 line 1 above less state refund that will be received on 2017 Form 1099-G Multiply line 1 by 80 80 Enter the amount from 1040 line 38 Enter. Yes Multiply the number in the box on line 39a of your 2017 Form 1040 by 1250 1550 if your 2017 filing status was single or head of household. Form 1040 2018 State and Local Income Tax Refund Worksheet.

Yes Multiply the number in the box on line 39a of your 2016 Form 1040 by 1250 1550 if your 2016 filing status was single or head of household. Refunds attributable to post 123120XX payments per IRS Pub. For information including worksheets for reporting these refunds see the 2018 instructions for Form 1040 US.

Yes Subtract line 5 from line 2 No STOP None of your refund is taxable. Taxable part of your refund. Click the checkbox es to the left of Form 1040 State Refund - State Refund Worksheet the top section contains individual forms or schedules and the bottom section contains documents or worksheets.

State and local taxes paid from prior year Schedule A line 5. Need the blank Form 1040 Line 10 State and Loc. On average this form takes 3 minutes to complete.

State and Local Income Tax Refund WorksheetSchedule 1 Line 1. State income tax refunds can sometimes be taxable income according to the IRS. State local tax refunds with no tax benefit derived due to AMT Per IRS Publication 525 taxpayers receiving a state or local income tax refund for a prior tax year during the current year must generally include it in income as a recovery if it was deducted on the prior years tax return.

Look for a worksheet named Wks CY Refunds 20XX State and Local Income Tax Refund Worksheet and review it for information on whether or not there will be a taxable event. Net operating loss NOL deduction. 311300MFJ 285350HOH 259400S 155650MFS.

You must report them on line 1 of Schedule 1 of the 2020 Form 1040 the return youd file in 2021if you claimed a deduction for state and local taxes the year before. Net state and local income tax refunds Add lines 1 and 2 4. The State Refund Worksheet reflects the calculation of the amount if any of the state income tax refund received that would be taxable and transferred to Line 1 of Schedule 1 Form 1040 Additional Income and Adjustments to Income.

/1040-NR-EZ-NonresidentAlienswithNoDependents-1-992eb3e7ab6d49b782ad46ab42ae00e5.png)

Form 1040 Nr Ez U S Income Tax Return For Certain Nonresident Aliens With No Dependants Definition

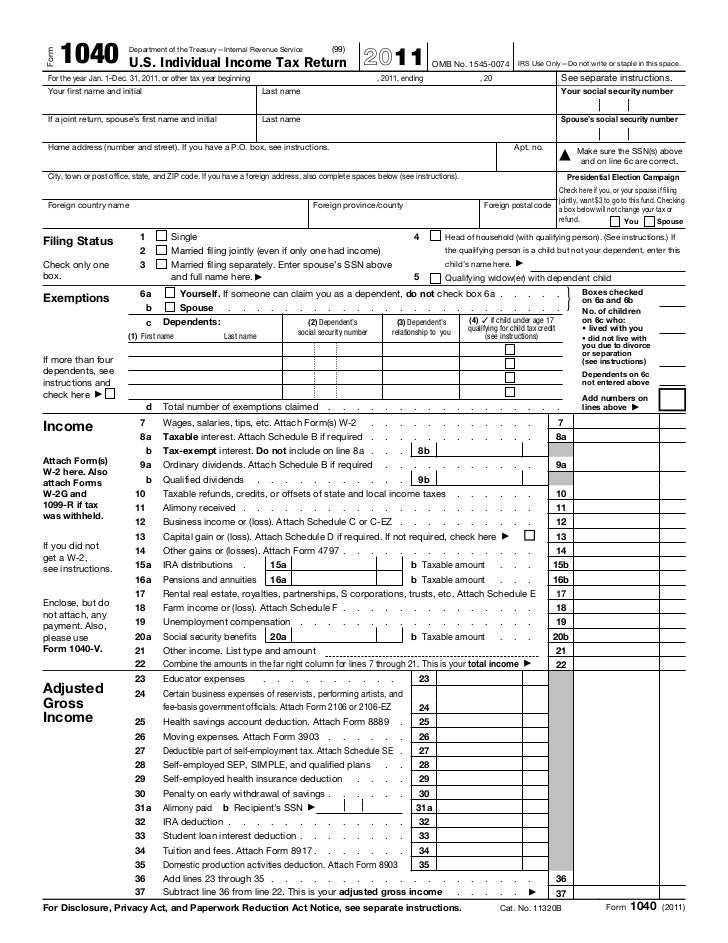

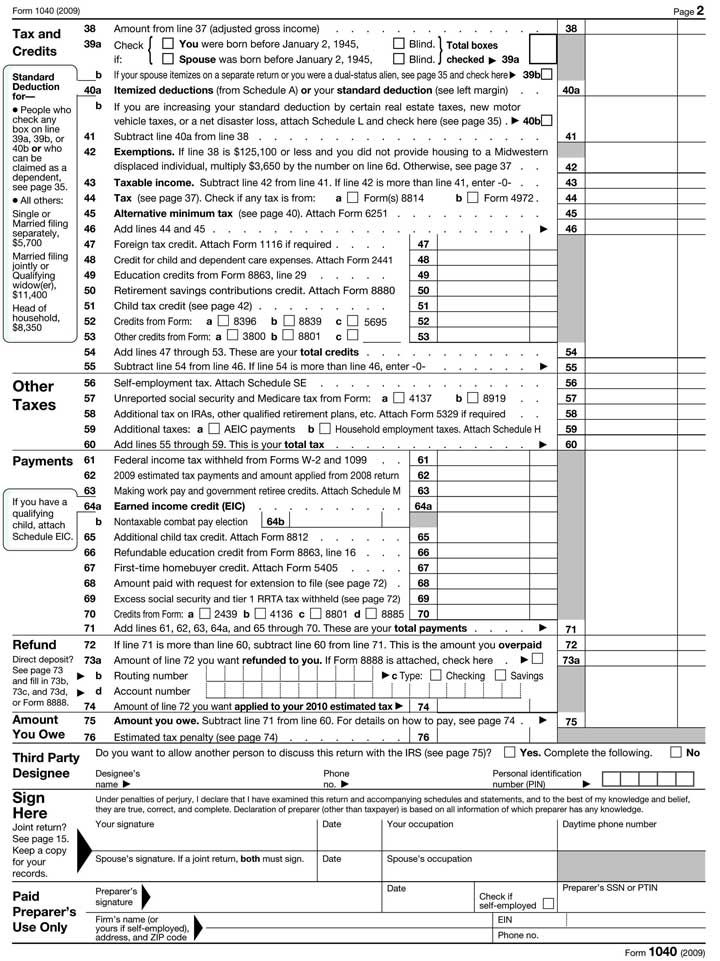

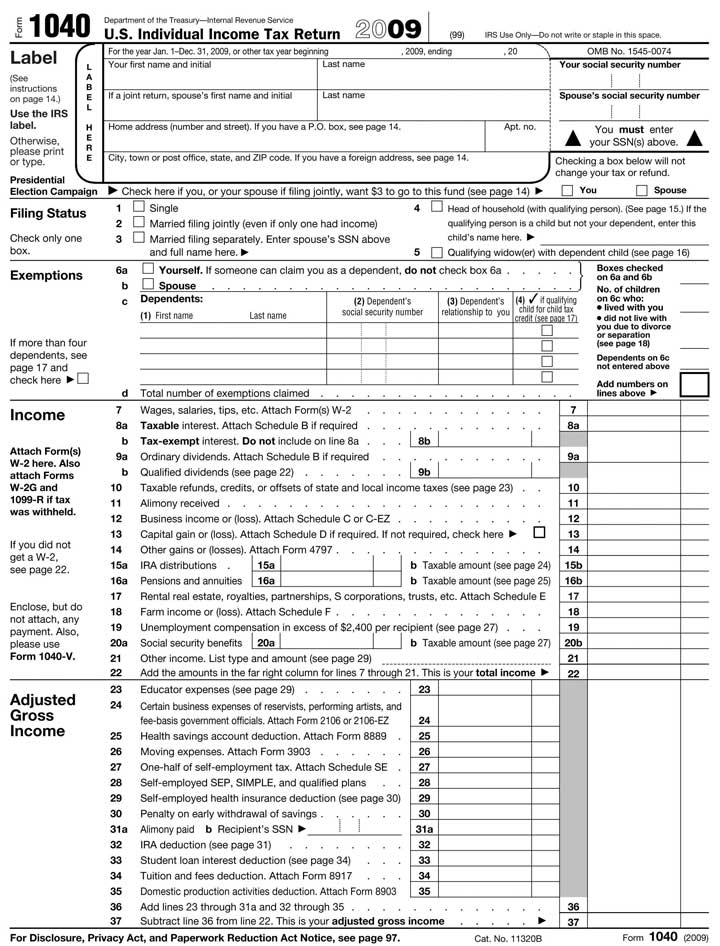

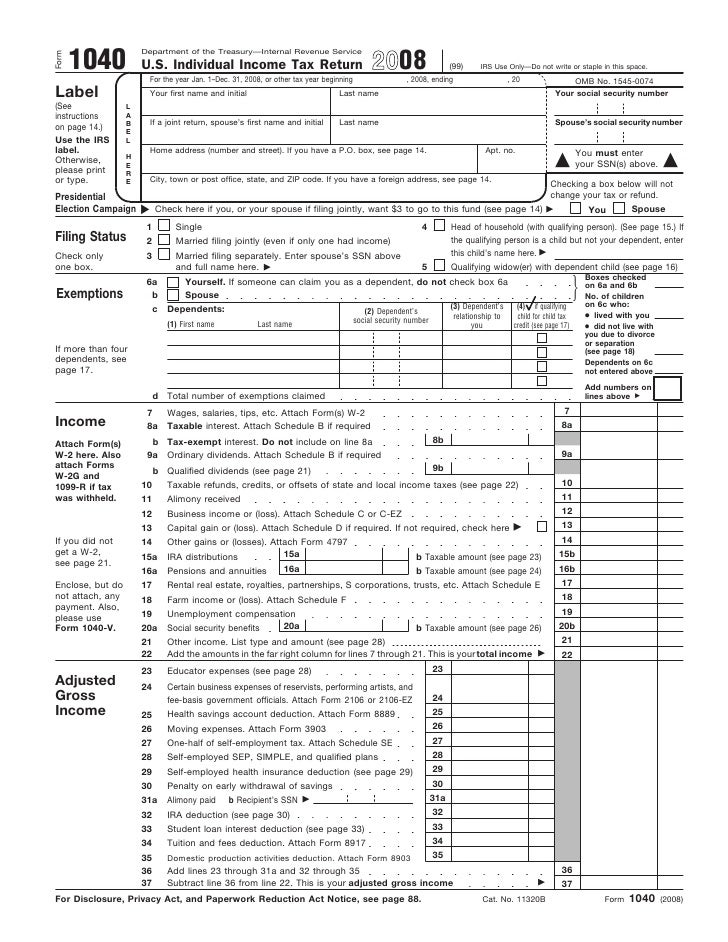

Form 1040 U S Individual Tax Return In 2021 Irs Tax Forms Tax Forms Irs Taxes

U S Individual Income Tax Return Forms Instructions Tax Table F1040 I1040 I1040tt By Legibus Inc Issuu

The U S Federal Income Tax Process

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Tax Forms

Understanding Your Us Expat Taxes And Form 1040

How Do I Access My Form 1040 Online Get Answers To All Your Questions About Taxes Personal Finance Insurance And More Taxes Filing Taxes Tax Guide Tax

The U S Federal Income Tax Process

Use Excel To File 2015 Form 1040 And Related Schedules Accountingwebhow To Use Excel To File 2015 Form 1040s

Download Federal Income Tax Form 1040 Excel Spreadsheet Income Tax Calculator Tax Return Federal Income Tax Tax Forms

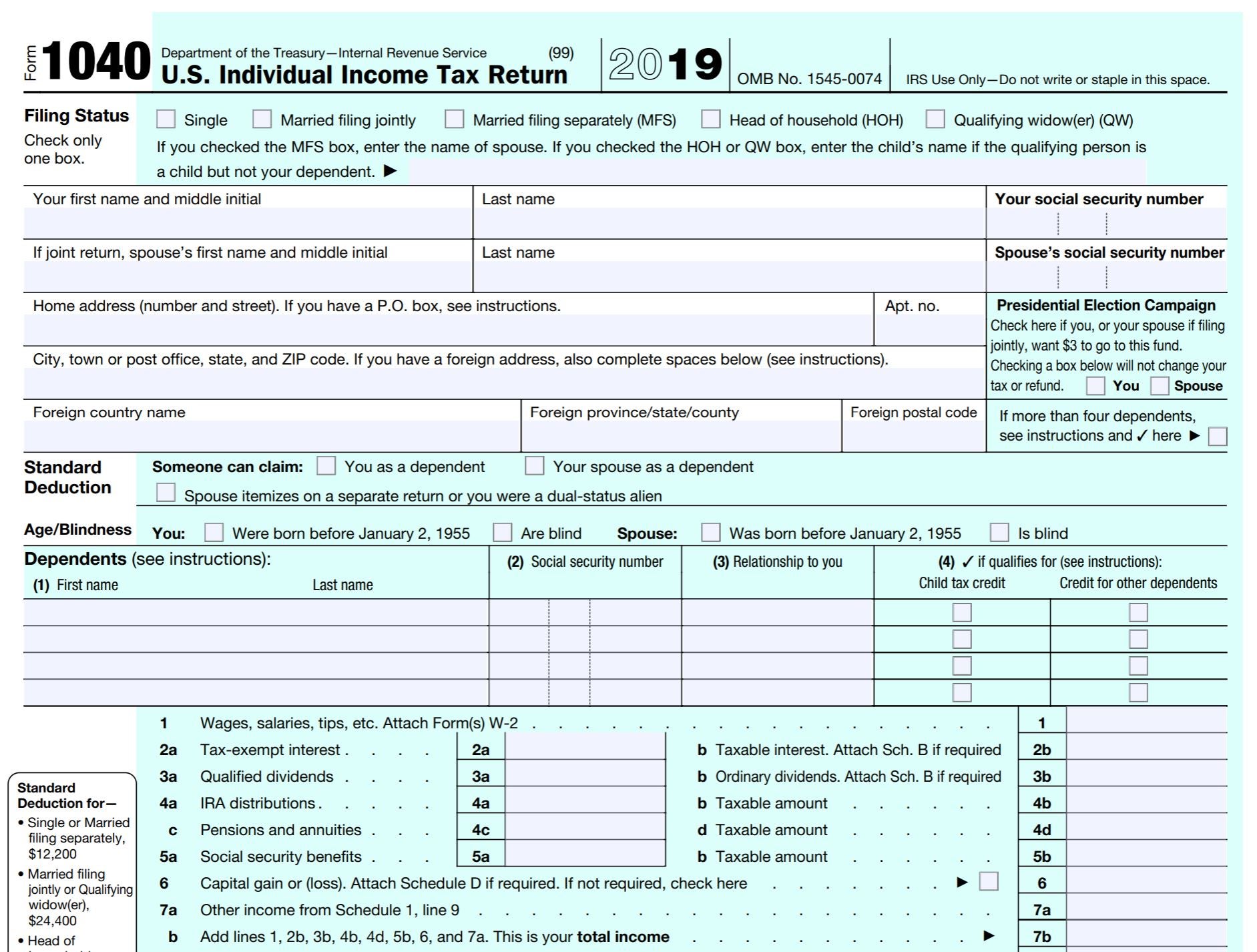

Form 1040 U S Individual Income Tax Return

/1040-NR-EZ-NonresidentAlienswithNoDependents-1-992eb3e7ab6d49b782ad46ab42ae00e5.png)

Form 1040 Nr Ez U S Income Tax Return For Certain Nonresident Aliens With No Dependants Definition

Foreign Tax Credit Form 1116 And How To File It Example For Us Expats

Examples Of Tax Documents Office Of Financial Aid University Of Colorado Boulder

Https Apps Irs Gov App Vita Content Globalmedia State And Local Refund Worksheet 4012 Pdf

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

Spreadsheet Based Form 1040 Available At No Cost For 2013 Tax Year Accountingweb

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Form 1040 Is One Of Three Irs Tax Forms Used For Personal Federal Income Tax Returns Filed With The Internal Revenue Irs Tax Forms Irs Taxes Federal Income Tax